Redesigning education in Michigan – Conclusion

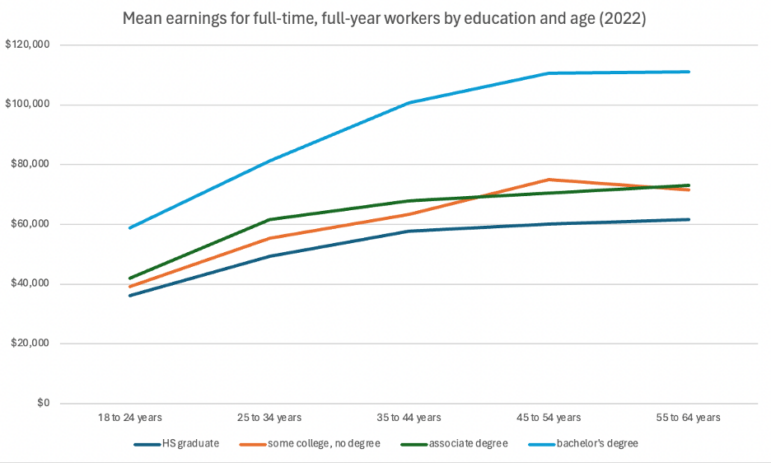

Over the past several weeks, I wrote a series of posts about the importance of educational attainment – both to our statewide economy and to individual economic mobility and prosperity – and how we should be designing our K-16 education system to increase the number of Michiganders who attain bachelor’s degrees. This is the fourteenth […]

Redesigning education in Michigan – part 13: Policy levers to improve outcomes at Michigan community colleges

Over the next several weeks, I’ll be writing a series of posts about the importance of educational attainment – both to our statewide economy and to individual economic mobility and prosperity – and how we should be designing our K-16 education system to increase the number of Michiganders who attain bachelor’s degrees. This is the […]

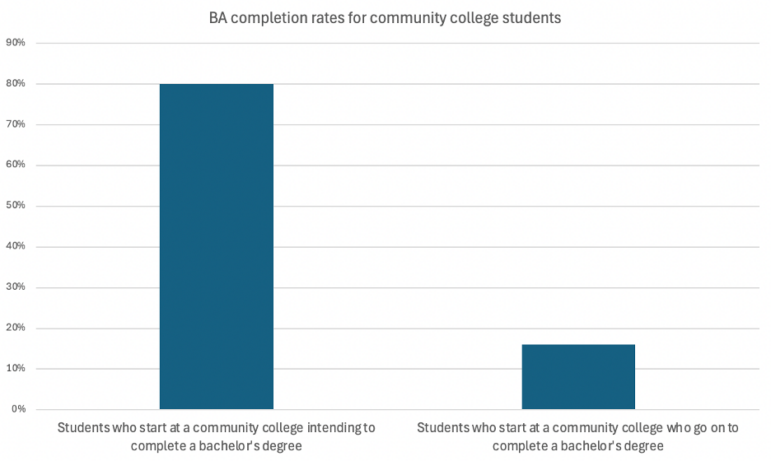

Redesigning education in Michigan part 12 – Improving completion rates at Michigan’s community colleges

Over the next several weeks, I’ll be writing a series of posts about the importance of educational attainment – both to our statewide economy and to individual economic mobility and prosperity – and how we should be designing our K-16 education system to increase the number of Michiganders who attain bachelor’s degrees. This is the […]

Redesigning education in Michigan part 11 – Public policy levers to boost completion rates at 4-year colleges

Over the next several weeks, I’ll be writing a series of posts about the importance of educational attainment – both to our statewide economy and to individual economic mobility and prosperity – and how we should be designing our K-16 education system to increase the number of Michiganders who attain bachelor’s degrees. This is the […]

Redesigning education in Michigan Part 10 – Improving completion rates at four-year colleges

Over the next several weeks, I’ll be writing a series of posts about the importance of educational attainment – both to our statewide economy and to individual economic mobility and prosperity – and how we should be designing our K-16 education system to increase the number of Michiganders who attain bachelor’s degrees. This is the […]

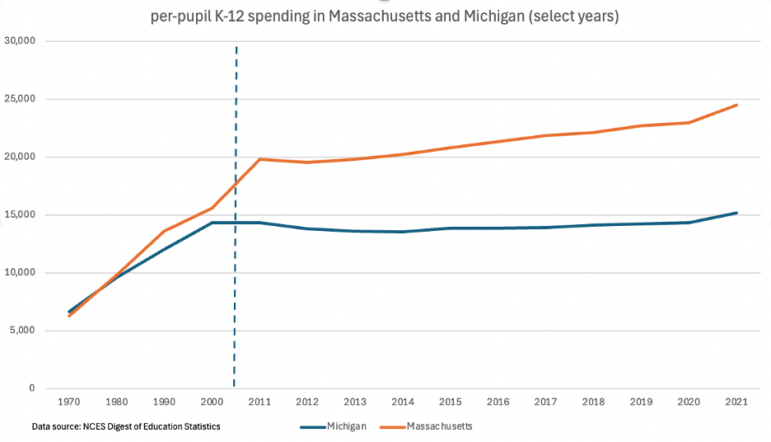

Redesigning education in Michigan Part 9 – Increasing BA attainment will require increasing K-12 funding

Over the next several weeks, I’ll be writing a series of posts about the importance of educational attainment – both to our statewide economy and to individual economic mobility and prosperity – and how we should be designing our K-16 education system to increase the number of Michiganders who attain bachelor’s degrees. This is the […]

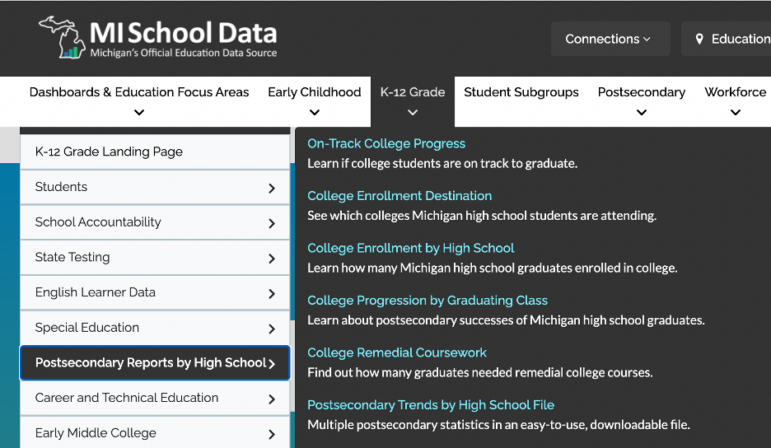

Redesigning education in Michigan Part 8 – Holding school systems accountable to postsecondary success

Over the next several weeks, I’ll be writing a series of posts about the importance of educational attainment – both to our statewide economy and to individual economic mobility and prosperity – and how we should be designing our K-16 education system to increase the number of Michiganders who attain bachelor’s degrees. This is the […]

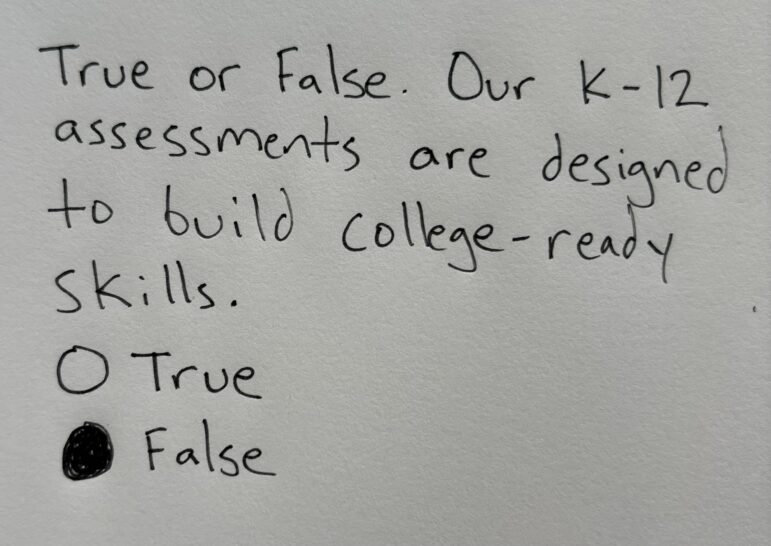

Redesigning education in Michigan – Part 7: An assessment system designed for college success

Over the next several weeks, I’ll be writing a series of posts about the importance of educational attainment – both to our statewide economy and to individual economic mobility and prosperity – and how we should be designing our K-16 education system to increase the number of Michiganders who attain bachelor’s degrees. This is the […]

Redesigning education in Michigan – Part 6: Building college-ready skills in K-12

Over the next several weeks, I’ll be writing a series of posts about the importance of educational attainment – both to our statewide economy and to individual economic mobility and prosperity – and how we should be designing our K-16 education system to increase the number of Michiganders who attain bachelor’s degrees. This is the […]

Redesigning education in Michigan – Part 5: Developing writers

Over the next several weeks, I’ll be writing a series of posts about the importance of educational attainment – both to our statewide economy and to individual economic mobility and prosperity – and how we should be designing our K-16 education system to increase the number of Michiganders who attain bachelor’s degrees. This is the […]