Reframing the goal of Michigan’s education system

It’s becoming clear that K-12 education is poised to be a central issue in the 2026 Michigan gubernatorial race, as it should be. On the 2024 NAEP reading exam (the National Assessment of Educational Progress, often called the Nation’s Report Card), just 24 percent of Michigan 4th graders scored at or above the NAEP proficiency […]

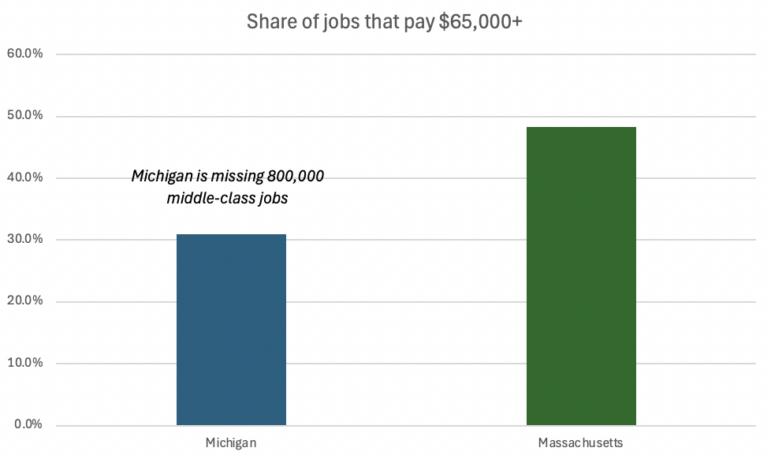

Michigan’s Missing 800,000 Middle-Class Jobs

Key takeaways Since the turn of the century, our state has experienced a precipitous decline in economic prosperity relative to the rest of the country. In 1999, Michigan ranked 16th in per-capita income. In 2023, we ranked 39th. And the slide shows no signs of slowing. What we have been doing over the past 25 […]

Redesigning education in Michigan – Conclusion

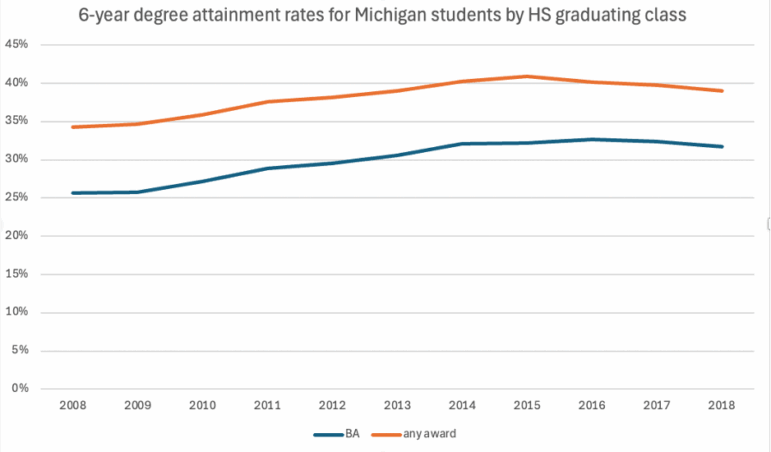

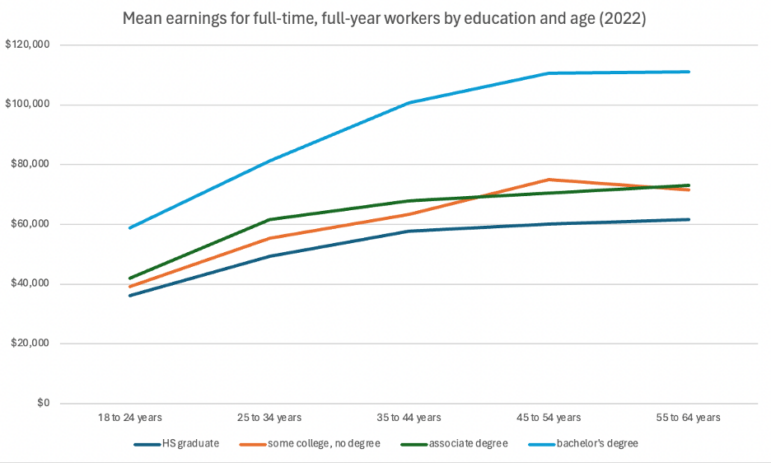

Over the past several weeks, I wrote a series of posts about the importance of educational attainment – both to our statewide economy and to individual economic mobility and prosperity – and how we should be designing our K-16 education system to increase the number of Michiganders who attain bachelor’s degrees. This is the fourteenth […]

Redesigning education in Michigan – part 13: Policy levers to improve outcomes at Michigan community colleges

Over the next several weeks, I’ll be writing a series of posts about the importance of educational attainment – both to our statewide economy and to individual economic mobility and prosperity – and how we should be designing our K-16 education system to increase the number of Michiganders who attain bachelor’s degrees. This is the […]

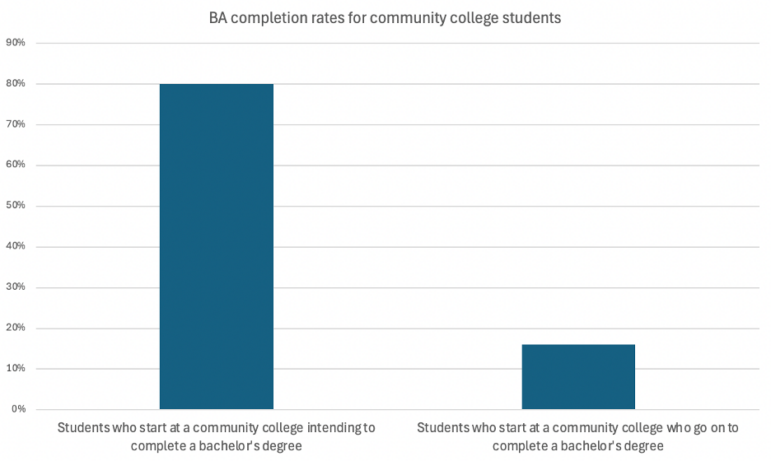

Redesigning education in Michigan part 12 – Improving completion rates at Michigan’s community colleges

Over the next several weeks, I’ll be writing a series of posts about the importance of educational attainment – both to our statewide economy and to individual economic mobility and prosperity – and how we should be designing our K-16 education system to increase the number of Michiganders who attain bachelor’s degrees. This is the […]

Redesigning education in Michigan part 11 – Public policy levers to boost completion rates at 4-year colleges

Over the next several weeks, I’ll be writing a series of posts about the importance of educational attainment – both to our statewide economy and to individual economic mobility and prosperity – and how we should be designing our K-16 education system to increase the number of Michiganders who attain bachelor’s degrees. This is the […]

Redesigning education in Michigan Part 10 – Improving completion rates at four-year colleges

Over the next several weeks, I’ll be writing a series of posts about the importance of educational attainment – both to our statewide economy and to individual economic mobility and prosperity – and how we should be designing our K-16 education system to increase the number of Michiganders who attain bachelor’s degrees. This is the […]

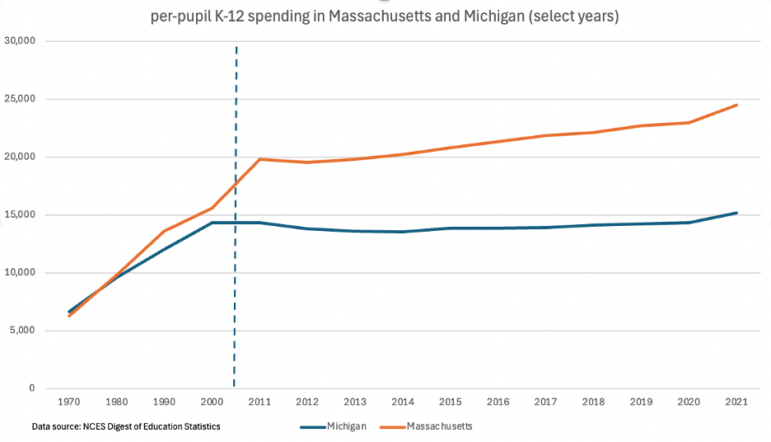

Redesigning education in Michigan Part 9 – Increasing BA attainment will require increasing K-12 funding

Over the next several weeks, I’ll be writing a series of posts about the importance of educational attainment – both to our statewide economy and to individual economic mobility and prosperity – and how we should be designing our K-16 education system to increase the number of Michiganders who attain bachelor’s degrees. This is the […]

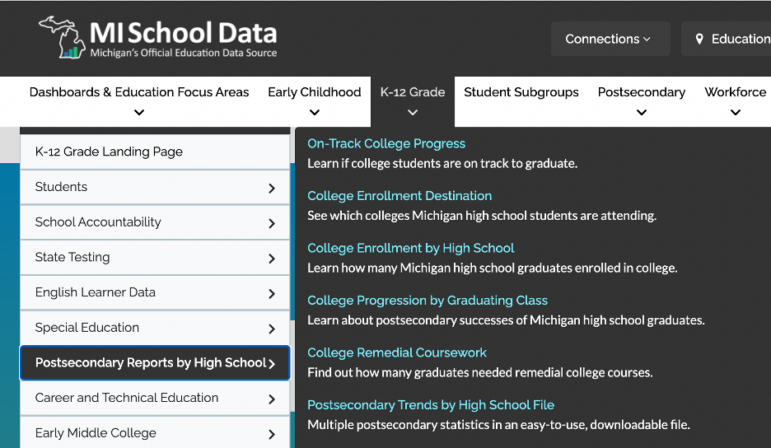

Redesigning education in Michigan Part 8 – Holding school systems accountable to postsecondary success

Over the next several weeks, I’ll be writing a series of posts about the importance of educational attainment – both to our statewide economy and to individual economic mobility and prosperity – and how we should be designing our K-16 education system to increase the number of Michiganders who attain bachelor’s degrees. This is the […]

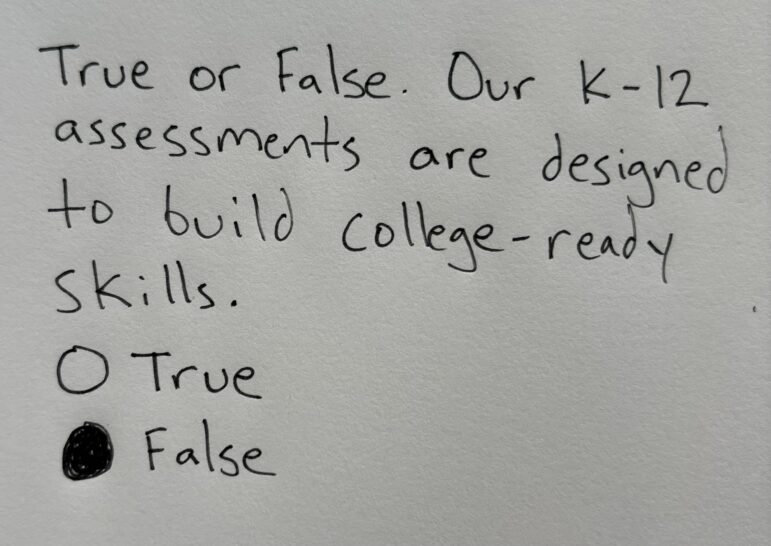

Redesigning education in Michigan – Part 7: An assessment system designed for college success

Over the next several weeks, I’ll be writing a series of posts about the importance of educational attainment – both to our statewide economy and to individual economic mobility and prosperity – and how we should be designing our K-16 education system to increase the number of Michiganders who attain bachelor’s degrees. This is the […]