As Michigan, almost certainly, faces its most serious economic challenge since the Great Depression, it is worth recalling how Michigan has dealt with previous economic downturns.

What follows is a rerun of a post I did in 2012 entitled Jim Blanchard, Jobs and Taxes. It has been lightly edited and the data brought up to date.

As many of you know I worked for Governor Blanchard, I thought then – and even more so now – he was real good for the people of Michigan. His administration was about one thing: jobs. His record is exemplary.

What follows are the facts on the economic results during his eight years in office and the fiscal policies he put in place to grow the Michigan economy.

First, Governor Blanchard inherited a Michigan economy in worse shape – one can make a strong case far worse shape – than Governor Snyder. We have short memories. The story we have told ourselves over and over again that Governor Snyder inherited the worse economy in Michigan since the Great Depression is not true.

Jim Blanchard took office in January 1983. The month before (December, 1982) the state’s unemployment rate was 16.8%. And going up. That month was the peak unemployment rate during the serve downturn of the early Eighties. For all of 1982 the unemployment rate was 15.6%.

Rick Snyder took office in January 2011. The month before (December, 2010) the state’s unemployment rate was 11.2%. And going down. The peak Michigan unemployment rate during the Great Recession was 14.2% in August, 2009. When Governor Snyder took office the Michigan unemployment rate had been falling for 16 consecutive months. For all of 2010 the unemployment rate was 12.7%.

Lets turn our attention to what Governor Blanchard did to grow the Michigan economy and what the results were. First and foremost Jim Blanchard raised taxes. He cut spending as well to deal with a huge budget deficit he inherited along with a horrible economy. Governor Blanchard defied the conventional wisdom of his day – and far more so today – that believed low tax states had the best economies and, even more so, you never raise taxes in an economic downturn.

The income tax went from 4.6% to 6.35%. You read that right: 6.35%. Only one Republican in the state House and Senate – Senator Harry DeMaso – voted for the tax increase. The rest predicted economic ruin. The income tax rate was 6.35% for calendar year 1983 and through August, 1984. When it was reduced to 5.35% through March 1986. When it went back to 4.6% for the remainder of the Blanchard Administration. (The income tax history comes from the Citizens Research Council.)

This was a period not only of higher income tax rates, but the dreaded Single Business Tax – the so-called job killer – was in full force with a rate of 2.35% for the entire Blanchard Administration.

Economic ruin? Hardly!

During the eight years of the Blanchard Administration employment in Michigan went from 3,193,000 in 1982 (the year before he took office) to 3,946,000 in 1990 (the year he left office). An increase of 753,000 jobs. The biggest annual job gains occurred in the three years when the higher income tax rates were in full effect: 1983-5. Job growth in those three years was from 3,193,000 to 3,561,000. An increase of 368,000, an average of almost 123,00 per year. Over the eight years the state’s annual average unemployment rate went from 15.6% in 1982 to 7.7% in 1990.

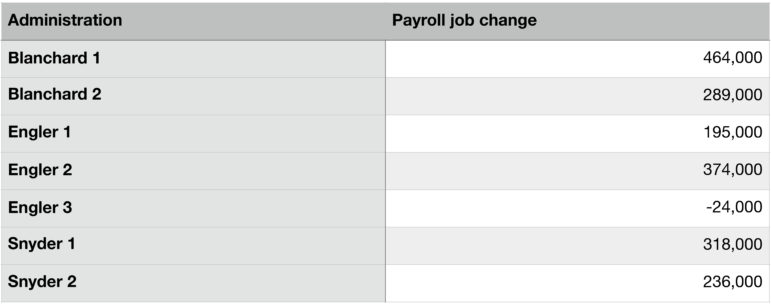

As the table below makes clear the Blanchard years saw greater growth in payroll jobs than either the Engler years or the Snyder years. Michigan governors who cut taxes as the center piece of their economic growth strategies.

The first Blanchard Administration––when the highest income tax in Michigan history was in effect––had the largest gain in payroll jobs. The annual average payroll job growth in the Blanchard years was 94,000; in the Engler years 45,000, and in the Snyder years 69,000.

So much for you can’t raise taxes and get job and economic growth!

Having said that I don’t believe that the Blanchard tax increases were a major reason for Michigan’s growth in the Eighties. Anymore than I believe the Engler tax cuts were a major reason for Michigan’s economic growth in the Nineties. Or the Snyder business tax cuts had much of anything to do with the growth we experienced in the 2010s.

The evidence is overwhelming that what drives Michigan’s economy is the national economy and, most importantly, the domestic auto industry. State policy is at best a weak lever in driving the economy.

But what the Blanchard years demonstrate is that you can raise taxes and have strong growth. When you both raise taxes and control spending during a severe downturn you can both grow the economy and improve the standard of living and quality of life of all Michiganders by having adequate funds for a decent safety net and public investments in education, quality of place and infrastructure.