Using averages over anecdotes

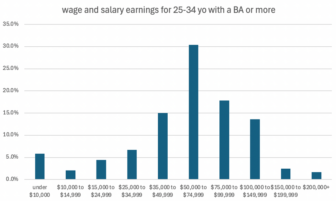

The story of the underemployed college graduate refuses to die. If you look back across the past half century, it is not hard to find

The story of the underemployed college graduate refuses to die. If you look back across the past half century, it is not hard to find

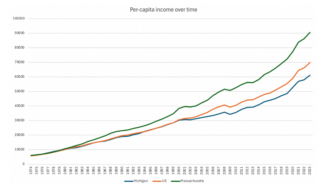

When people make the argument that you don’t need a four-year degree to get a good-paying job, they will often say that you can make

Michigan Future Inc., a Michigan-focused nonpartisan, nonprofit think tank, today announced the addition of Rosalynn Bliss and Dan Kildee to its board of directors. Bliss

This post is authored by Punita Thurman For more than two decades, Michigan Future Inc. (MFI) has been calling on policymakers, business leaders, and civic

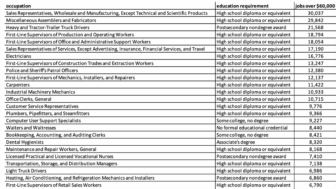

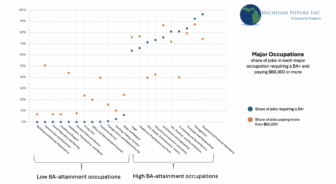

A central takeaway of our analysis of the Michigan labor market is that two-thirds of all Michigan jobs that pay more than $60,000 are in

We recently conducted a webinar presenting our analysis of the latest occupation and wage data on the Michigan economy, released by the Bureau of Labor

February 26, 2026

January 27, 2026

November 21, 2025