We have been arguing that our proposal for a working parents tax cut would be transformational for hardworking Michigan parents with young children. Our proposed credit would direct $5,000 to EITC-eligible Michigan parents for each child they have under the age of 3, and $2,500 for each child between the ages of 3 and 6. The credit is designed to help working parents with young children pay for basic necessities, in particular the high cost of childcare, and combat the benefit cliff.

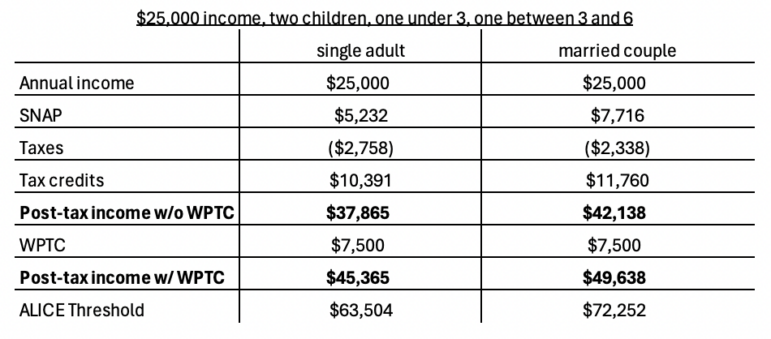

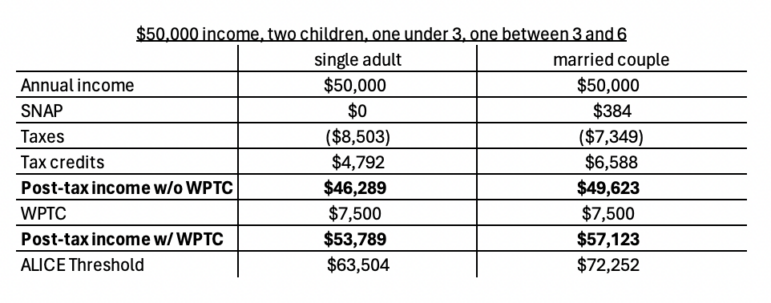

To get a sense of what we mean by transformational, we have outlined below how the credit would impact the finances of four case families: the first table shows a single and two-parent household earning $25,000 annually, and the second table shows a single and two-parent household earning $50,000 annually. Each household has two children, one under the age of three and one between the ages of three and six, so they would receive a $7,500 credit ($5,000 for the younger child, and $2,500 for the child over 3 and under 6).

Before applying the WPTC, a single adult with two young children and $25,000 in work earnings would have a post-tax income of roughly $38,000. We arrive at this figure after the addition of roughly $15,000 in SNAP benefits, state and federal Earned Income Tax Credits, and the federal Child Tax Credit, and the subtraction of nearly $3,000 in income through payroll and income taxes. After applying this family’s $7,500 WPTC, their total net income rises to over $45,000. If broken down to an hourly basis for a full-time, full-year worker, this would amount to a raise of more than $3.50 per hour – a rapid boost in income that no workforce development program can deliver.

While the WPTC is sorely needed for this case family, note also how critical it is for those case families earning $50,000 from work. A single adult with two children earning $50,000 has a post-tax income of just over $46,000, just $8,000 more than the pre-WPTC income of the household earning $25,000 from work. This is the so-called “benefit cliff” at work. As work income rises, a household’s tax burden (payroll and income tax) increases while their public benefits (e.g., SNAP and refundable tax credits) decline. So this household, whose income from work already places them well-below the ALICE threshold (the United Way’s estimate of what a Michigan household needs to afford basic necessities), is left even worse off after applying taxes and public benefits.

Enter the Working Parents Tax Credit. After applying the WPTC, their post-tax income would rise back above their work earnings (~$54,000), providing a meaningful boost to help this household pay for basic necessities, including the high cost of childcare.

For all case families, it’s also worth noting just how far below the ALICE thresholds they sit, even with the addition of the WPTC. These households (and it should be noted that nearly 30% of Michigan households with children have incomes of less than $50,000) will continue to face challenges paying for basic necessities – but they will struggle a lot less with an additional $7,500 in their pockets.