As is often discussed on this blog, there is perhaps nothing more important to the health of Michigan’s economy than increasing the proportion of Michiganders with four-year college degrees. However, based on our state’s investment in higher education, you wouldn’t know it.

For individuals, earning a bachelor’s degree is the best way to arm yourself in an economy where knowledge workers are increasingly in demand. Since the start of the recession the economy has added 8.6 million jobs filled by four-year college grads, while for those with a high school degree or less employment has declined by 5.5 million jobs. And almost all of the “good” jobs added to the economy since the end of the recession (those with salaries over $53,000) have gone to those with a four-year degree. For an individual, the evidence is overwhelming – earning a four-year college degree gives you the best chance of being employed and being employed at a good wage.

The evidence is also overwhelming that more four-year degrees for Michiganders means a stronger state economy. Of the top ten states with the highest net earnings per capita, eight also rank in the top ten in the proportion of individuals with a bachelor’s degree or more; the two that don’t are the oil-rich states of North Dakota and Alaska.

Unfortunately, our investment in our four-year institutions does not reflect the economic importance of increasing the number of Michiganders with four-year degrees.

Since 2001, higher education appropriations for our public universities have dropped precipitously, from $1.9 billion to $1.5 billion in nominal terms, an almost 40% drop when adjusted for inflation. And while this is technically a cut to university budgets, it’s Michigan students who suffer.

University budgets are made up almost exclusively of two major inputs: state appropriations and student tuition. When appropriations drop, tuition rises. And this is exactly what has happened in Michigan, to an alarming degree. In 1985, Michigan public universities received roughly 60% of their operating budgets from state appropriations, relying on student tuition for 30%, with the rest coming from other sources. That year, tuition at Michigan State University was around $3,000 in 2016 dollars. By 2001, this mix had shifted such that roughly 45% of university budgets came from state appropriations and 45% from tuition, with MSU’s tuition doubling to around $7,000 in 2016 dollars.

Since 2001, the rapid decline in state support for our public universities has led them to lean on tuition even more. Today, only 20% of university operating budgets come from state support, while 70% comes from student tuition. Over this time MSU’s tuition increased to the $13,500 it is today, nearly doubling in real terms over the past 15 years.

While I’ve been using MSU as an example, the picture is even worse at the state’s “open-access” universities like Central Michigan University, that don’t have the institutional resources needed to slow tuition growth or offset high tuition with generous need-based grants (MSU has a $2.3 billion endowment, while CMU has an endowment of $108 million). At CMU, tuition was around $4,800 in 2001 (in 2016 dollars), and has since increased to over $12,000, more than doubling.

The high price of college presents a formidable obstacle to both college access and success, particularly for lower and middle income students. Most of our public institutions can’t offer enough need-based aid to make college affordable, even after students max out their federal loans, leading students to opt for community college where completion rates are much lower, or forcing parents to take out potentially risky Parent PLUS loans.

In addition to limiting access, high tuition costs also impact lower and middle-income students’ likelihood of success in college. In our own work with Detroit high schools we saw many students’ college momentum hampered by finances as they failed to buy books, attended school part-time, or missed a tuition payment.

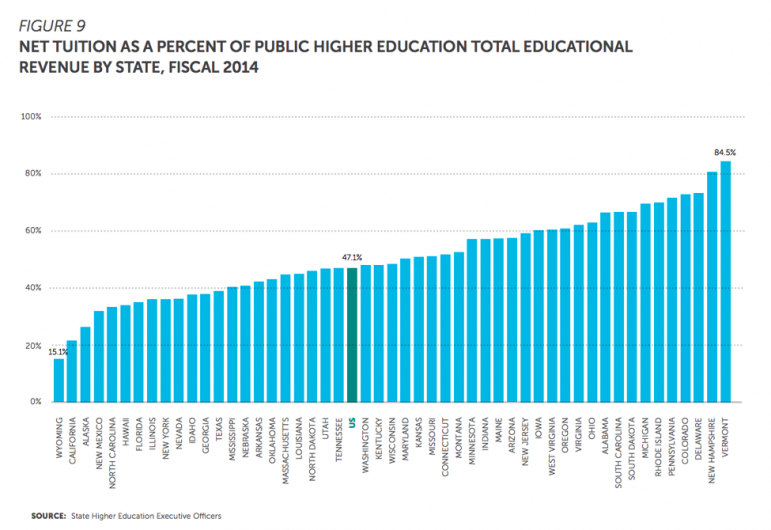

The chart below, from a report by the State Higher Education Executive Officers Association, shows the proportion of public university budgets consisting of tuition for each state in the country. With 70% of university funding coming from tuition, Michigan is seventh worst in the nation in the share of operational funding we put on the backs of students. At the other end of the spectrum, California serves as a model for how to pay for public higher education with public funds, with just 20% of operational funding for their four-year public universities coming from tuition, and the rest coming from the state. While the prestigious UC system of schools still have high price-tags on par with U of M and MSU, public support allows the California State system of four-year universities to keep their tuition down to around $5,500, less than half of the average tuition at Michigan public institutions.

While finances are just one of the myriad obstacles students face in their college education, it’s one that we should eliminate. With Michigan relying so much on student tuition to fund our universities, education at these public institutions has become a largely private enterprise, with families and individuals left to pay for college on their own. And with the futures of both Michigan students and the Michigan economy so dependent on the completion of four-year degrees, affordability shouldn’t be something we leave to chance.