Not good news for Michigan. The unemployment rate is going up again. Up to 9.0% in August from a post recession low of 8.4% in both April and May 2013.

This turn for the worse, comes with the huge Snyder business tax cuts in effect. You know the ones that were supposed to drive Michigan’s economic comeback from the depths of the Great Recession. Think again!

Turns out the business tax cuts did get us higher ratings in the Tax Foundation’s 2013 Business Tax Climate Index. Where Michigan is now ranked 7th in business taxes. Which the Snyder Administration (and many others) celebrates as a major accomplishment. But as we have explored previously doing well in business climate ratings has little to do with what really matters: whether Michiganders have more and better jobs.

Minnesota on the other hand has an unemployment rate that is falling. 5.1% in August, their post Great Recession low. The number of unemployed in Minnesota is down ten percent over the past year compared to less than two percent in Michigan. Minnesota’s Tax Foundation business tax ranking is 44th. So much for low business taxes driving more and better jobs!

I’m not a big fan of the unemployment rate as a measure of economic well being. Particularly the monthly unemployment rate. But it is what everyone else uses as the basic measure of how well a state’s economy is performing. In this case the unemployment rate comparison is aligned with all the economic measures that matter more. The employment to population ratio, per capita income, private sector employment earning per capita, poverty rate, on and on and on. On each Minnesota has the best performance in the Great Lakes. Far better than Michigan. And with Michigan the gap is growing larger. (You can find a Minnesota economy overview here.)

So in two huge business tax cuts we have given away more than $2 billion a year in state and local taxes. For what? Certainly not a lot of new jobs. And because of those tax cuts (and many others the past 15 years or so) we have been forced to slash the public investments that matter to long term economic prosperity: education, infrastructure and quality of place.

Minnesota has done the opposite. Starting with higher taxes and just raising them again to protect their ability to make important public investments.

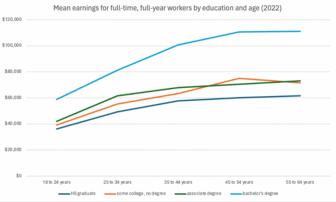

I don’t know whether Michigan’s unemployment rate over the next several months is going to go up or down. But it is almost certain that for the foreseeable future Minnesotans are going to enjoy better economic outcomes (both employment and income) than Michiganders. Because Minnesota has both the concentration of knowledge based employers and college educated adults that are the main drivers of more and better jobs.

And to the degree that state, regional and local policy matters, the evidence strongly suggests that their public investment driven policies work far better than our tax cut driven policies in building the assets that matter most.