I’m frequently asked about the effects of rising and high tuition on college attainment. I answer in two parts. The first is obvious, of course, high tuition to some degree depresses college attendance.

In a recent article AP’s Kathy Barks Hoffman provides an excellent overview of how declining state aid has been a major contributor to rising tuition. Hoffman writes: College students this fall will pay more than twice as much in tuition at the state’s 15 public universities as students paid 10 years ago, taking about $5,000 more out of their pockets. … Mike Boulus of the Presidents Council, which represents the 15 state universities, said the schools are being asked to take almost as big a cut this fall as they took over the combined eight years Democrat Jennifer Granholm was governor.

Granholm cut university spending 18 percent during her tenure, or 37 percent when accounting for inflation. Now, with the 15 percent cut put in place by the Republican Snyder, state support has fallen even further. The state supplied 59 percent of university funding in 1992-93, according to the Presidents Council. It now supplies just 26 percent, putting three-fourths of the costs on the backs of students.

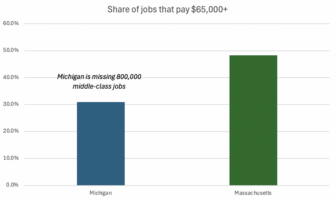

… Still, many worry too many students are being priced out of college, making it harder for the state to compete economically. Only Rhode Island and New Mexico cut university funding more than Michigan between the 2005 and 2010 fiscal years, and Michigan now is in the bottom five as far as university funding, Boulus said.

We have argued for years this is stupid. How we could have fallen to the bottom five is mind boggling. College attainment is not only the single best predictor of individuals economic well being but also of state prosperity. It certainly is one of the keys to returning Michigan to prosperity.

So we strongly believe the state should reverse the more than a decade of disinvestment in our terrific public higher education system. And do it in the form of assistance to students rather than institutions which should be the most effective mechanism for holding down tuition.

The second part of my answer is far less obvious. Which is that taking out loans for college is a good investment. And for those who are dedicated to getting a college degree is a far better option than not going to college because they cannot afford the tuition. Somehow as a society we have decided that college loans are a burden but taking out a loan to buy a home is a good investment. We urge new college graduates to buy a home at the same time that we bemoan the so called crushing burden of college loans. Without any real data I have long argued that the college loan is a better investment than the mortgage.

Now there is evidence that not only is that true, but that college is a better investment than stocks and bonds as well. It comes from a recent report from the Hamilton Project. Worth reading! The report asks: Where is the best place to invest $102,000? ($102,00 being their estimate of the average costs of getting a four year degree. It is a combination of tuition and lost wages from not working while in college.)

Their answer: Higher education is a much better investment than almost any other alternative, even for the “Class of the Great Recession” (young adults ages 23-24). In today’s tough labor market, a college degree dramatically boosts the odds of finding a job and making more money.

On average, the benefits of a four-year college degree are equivalent to an investment that returns 15.2 percent per year. This is more than double the average return to stock market investments since 1950, and more than five times the returns to corporate bonds, gold, long-term government bonds, or home ownership. From any investment perspective, college is a great deal.

Here is their graph of the relative return on investment:

An associates degree is the best investment in their calculations because they estimate the average cost of tuition and foregone wages as $28,000. They write: At first blush, the value of the associate’s degree really stands out because it provides a higher percentage return of over 20 percent. However, this impressive return mostly reflects the much lower cost of an associate’s degree relative to a four-year degree rather than a boost to long-run earnings. When compared to the lifetime earnings of four-year college graduates, workers with an associate’s degree still earn a good deal less. Thus, the rate of return does not tell the full story.

But what is clear from their data is that a college degree – either two years or four years – is a terrific investment even if it requires taking out student loans. The bottom line: Want to raise your standard of living over a lifetime, invest in your skills first!