Two years ago, the Michigan Future, Inc. Board proposed that the state expand its Earned Income Tax Credit tenfold. Going from a six percent match of the federal credit to sixty. This was at a time, when despite unprecedented federal funding and a multi-billion-dollar state budget surplus, expanding the EITC was on no one’s agenda.

The rationale for this transformational recommendation was our belief that Michigan needed a completely new approach to improving the economic well-being of working families. That far too many struggling working families was an ongoing reality of the Michigan economy.

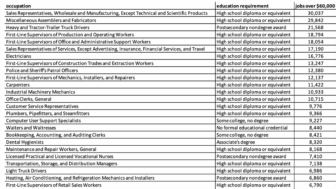

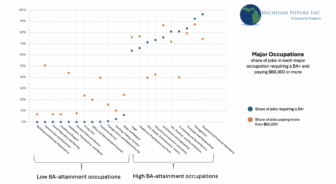

Nearly six-in-ten Michigan jobs pay less than what is required for a family of three to be middle class. The pandemic made clear that these low-wage workers live paycheck to paycheck not because they are irresponsibly buying “unnecessary” luxuries, but because they are in low-wage jobs that leave them struggling to pay for the necessities. The reality is that most of those struggling economically, in good times and bad, are hard-working Michiganders who like us get up every day and work hard to earn a living.

What these low-wage workers need most is income, not programs.

The EITC benefits workers, employers, and local communities:

- First and foremost, it allows families to make their own decisions about what the tax cuts will be used to pay for. Research has shown that families use the EITC for basic necessities- repairing homes, maintaining vehicles, food, and rent.

- The EITC encourages work: It is explicitly designed to encourage greater participation in the workforce because it is only available to families that work. In a time when many employers are having difficulty filling available jobs, the EITC has a proven track record of pulling people into the workforce.

- The EITC increases local purchasing power. EITC recipients spend most of the credit locally, so the bigger the credit, the more money spent in the local economy.

“But all jobs should be treated with respect. Jobs and living wages bring dignity, lead to more opportunity — in housing, education, childcare, health and overall well-being — and also help rebuild communities as that income is used to improve how people live. A major step would be to expand the Earned Income Tax Credit (EITC), which many Democrats and Republicans already agree upon.”– Jamie Dimon, chief executive officer of JPMorgan Chase

2022 Chairman & CEO Letter to Shareholders

The Michigan Working Families Tax Credit

2023 saw a historic expansion of the state’s match of the federal credit with the enactment of the Working Families Tax Credit which increased the state’s match from six percent to thirty. For the 2022 tax year 626,000 Michigan households will receive an average state credit of $775. Totaling $485 million in payments to Michigan working families.

The Working Families Tax Credit is a huge first step in moving to an income-based support system for Michigan’s working ALICE households. But there is more that needs to be done. The data are clear: you cannot have an economy that benefits all without increasing the income of low-wage workers––particularly those raising children––in their current jobs.

The next step: A Working Parents Tax Credit

The Michigan Future Board did not recommend a 60 percent state match as a negotiating gambit. Hoping to achieve something less but still more than the 20 percent which had been the previous high for Michigan’s credit. We put 60 percent on the table because of a belief that the best way to help low-wage workers is with income, not programs.

As a next step, we recommend enactment of a Working Parents Tax Credit. To provide Working Families Tax Credit recipient households with earnings of at least $10,000 from work with a refundable tax credit of $5,000 per child under the age of three and a refundable tax credit of $2,500 per child over the age of three and under the age of six. No household can receive a tax credit for more than three children. If possible, the payments will be made monthly.

It is estimated roughly 270,000 Michigan children under the age of six live in Working Families Tax Credit households. The estimated cost of the Working Parents Tax Credit is one billion dollars annually.

The per child credit is an essential feature of the proposal. Although the federal EITC has a long phase out––a two parent household with three or more children remains eligible for the credit in 2023 with income up to $63,694––it too contributes to the so-called benefit cliff. Where benefits decline as one earns more income.

Our detailed analysis of the benefit cliff found that households with children realized very little income gain as declining benefits and increasing taxes steeply offset increased earnings. This is particularly true for households with income between $20,000 and $40,000. Where households net as little as 14¢ from each additional dollar earned.

The best antidote for this high tax rate cliff is a flat per child credit that does not decline as you earn more money. The Working Parent Tax Credit is designed so that recipients will be able to keep a substantial proportion of increases in work earnings.

Focusing on households raising young children is also an essential component of the proposal. The Michigan Association of United Ways estimates the cost of paying for basic necessities for a two-adult household with no children is $38,508; for a household of two adults and two school age children it is $62,928; and for a household of two adults with two preschool children it is $72,792. The cost of childcare is the main driver of the increased cost of raising preschool children.

For households raising young children, the Working Parents Tax Credit both encourages work and provides a life-changing boost in income which can help families defray the cost of childcare.

We fully understand the implications of a new billion-dollar tax credit. At its core, the state budget is a statement of our values. At Michigan Future, Inc. we believe that the state’s core economic value should be rising income for all: an economy that as it grows benefits all. We value work and we value work where anyone who works hard earns enough to pay for the basics and to save for emergencies, retirement, and the kids’ education.

Expanded state tax credits for recipients of the federal EITC should be the cornerstone of a transformation in how the state supports working families. Moving away from a program-based support system to a cash-based safety net that benefits far more working families than any program can and that provides working families with increased income to pay the bills and save for emergencies, retirement, and the kids’ education.

The Working Parents Tax Credit is a win for Michigan families raising young children, employers, and the overall State economy. It meets all the criteria of good tax policy. It is fair (targeting relief to those most in need), efficient (tied directly as an incentive to work), and simple (no new bureaucracy).

Now is the time to enact a Working Parents Tax Credit.