The Working Parents Tax Credit (WPTC) is designed to substantially benefit both parents and employers. It is life-changing for parents and provides at scale, strong incentives to work and work more at a time when employers are having difficulty finding reliable workers.

The Working Parents Tax Credit (WPTC) would provide Earned Income Tax Credit recipient households with earnings of at least $10,000 from work a fully refundable tax credit of $5,000 per child under the age of three and a fully refundable tax credit of $2,500 per child over the age of three and under the age of six. No household can receive a tax credit for more than three children. It is estimated that the WPTC would benefit Michigan households raising 250,000 children under the age of six.

The WPTC benefits employers, by providing an at scale solution to three substantial impediments to working and working more: the difficulty low-wage workers face in paying for childcare, which the U.S. Chamber of Commerce Foundation estimates costs the Michigan economy nearly three billion dollars annually; the benefit cliff; and the reality that far too many working households are shut out of benefits they are eligible for by a confusing and limited scale system of safety net programs.

The Working Parents Tax Credit is only for people who are working – it’s helping people get back in the game, providing an incentive to go to work. That’s why employers like it.

The WPTC is pro work, both an incentive to work and a reward for work. The credit is designed to encourage individuals to enter the labor market. The credit is available only to households with at least $10,000 in work earnings.

Only EITC recipients are eligible for the WPTC. The EITC has a proven track record of pulling people into the workforce. In a comprehensive 2020 study on the employment effects of the EITC Diane Whitmore Schanzenbach and Michael R. Strain found:

The Earned Income Tax Credit (EITC) is the cornerstone anti-poverty policy in the United States. Designed to fight poverty by encouraging and rewarding work, decades of research on the EITC has found that the program meets its goals by increasing employment among targeted women, and by successfully raising their annual incomes, lifting millions of families out of poverty.

The cost and availability of childcare and the real and perceived loss of benefits as one works more are two big impediments to lower-wage workers working. The WPTC is designed to deal with both at scale.

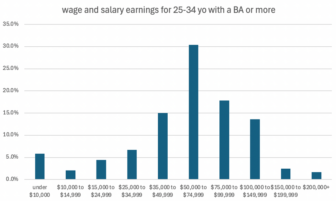

The per child credit is an essential feature of WPTC. Our detailed analysis of the benefit cliff found that households with children realized very little net income gain from increased work earnings, as declining benefits and increasing taxes steeply offset the increase in earnings. This is particularly true for households with income between $20,000 and $40,000, who net as little as 14 cents from each additional dollar earned.

The best antidote for this high tax rate cliff is a flat per child credit that does not decline as you earn more money. The Working Parent Tax Credit is designed so that recipients will be able to keep a substantial proportion of increases in work earnings.

Focusing on households raising young children is also an essential component of the WPTC. The Michigan Association of United Ways estimates the cost of paying for basic necessities for a two-adult household with

no children is $41,106; for a household of two adults and two school age children it is $64,752; and for a

household of two adults with two preschool children it is $73,488.

The cost of childcare is the main driver of the increased cost of raising preschool children. For households raising young children, the Working Parents Tax Credit provides a life-changing boost in income which can help families defray the cost of childcare. And because the credit goes to parents, it allows them to determine the childcare arrangement that works best for them and their children.

The WPTC is also flexible, so that it allows parents to pay for other necessities that is keeping them from work

There is no program/supply side solution the state can afford that can deal with the childcare challenge at scale. The current state child care subsidy program severs around 30,000 children. Tri-share fewer than 1,000. The WPTC will serve around 250,00 children.

The WPTC also benefits local businesses. The WPTC will primarily be spent buying goods and services from local businesses. Research indicates that families mostly use the EITC to pay for necessities, repair homes, maintain vehicles that are needed to commute to work, and in some cases, obtain additional education or training to boost their employability and earning power. Because the WPTC provides a flexible cash resource to families, that they can spend on whatever need is most pressing for their household, these dollars will be spent in much the same way. The credit will pump up to $935 million into local economies statewide.

The Working Parents Tax Credit is a win for Michigan employers, families raising young children, and the overall state economy. It meets all the criteria of good tax policy. It is fair (targeting relief to those most in need), efficient (tied directly as an incentive to work), and simple (no new bureaucracy).