The Working Parents Tax Credit (WPTC) is designed to substantially benefit both parents and employers. It is life-changing for parents and benefits employers by providing a strong incentive to work and work more.

The WPTC would provide Earned Income Tax Credit recipient households with earnings of at least $10,000 from work a fully refundable tax credit of $5,000 per child under the age of three and $2,500 per child over the age of three and under the age of six. No household can receive a tax credit for more than three children.

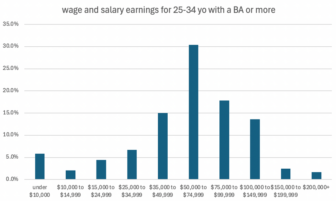

Six-in-ten Michigan jobs pay less than what is required for a family of three to be middle class. The pandemic made clear that these lower-wage workers live paycheck to paycheck not because they are irresponsibly buying unnecessary luxuries, but because they are in lower-wage jobs that leave them struggling to pay for necessities. The reality is that most of those struggling economically, in good times and bad, are hard-working Michiganders who, like us, get up every day and work hard to earn a living. What these lower-wage workers need most is income, not programs.

Expanded state tax credits for recipients of the federal EITC should be the cornerstone of a transformation in how the state supports working families. We should move away from a program-based support system to an income-based safety net that benefits far more working families than any program can, and provides working families with increased income to pay the bills and save for emergencies, retirement, and the kids’ education.

The WPTC is a fair, efficient, and simple tax policy that would help Michigan parents raising young children to help themselves in providing for their families.

More specifically the WPTC is good for parents because it:

- Combats the benefit cliff

- Helps to defray the high cost of childcare

- Provides parents with a flexible cash resource they can put towards their most pressing priority

- Can reach far more households than any program can

- Is easy to apply for and quality for

Combatting the benefit cliff

The per child credit is an essential feature of the proposal. For most government benefits, including the federal EITC, benefits decline as one earns more income, contributing to the so-called benefit cliff. Our detailed analysis found that households with children realized very little income gain as declining benefits and increasing taxes steeply offset increased earnings. This is particularly true for households with income between $20,000 and $40,000. Where households net as little as 14 cents from each additional dollar earned.

The best antidote for this high tax rate cliff is a flat per child credit that does not decline as you earn more money. The Working Parent Tax Credit is designed so that recipients will be able to keep a substantial proportion of increases in work earnings.

Paying for childcare

This proposal is targeted at households with young children for a reason. The Michigan Association of United Ways estimates the cost of paying for basic necessities for a two-adult household with no children is $41,106; for a household of two adults and two school age children it is $64,752; and for a household of two adults with two preschool children it is $73,488.

The cost of childcare is the main driver of the increased cost of raising preschool children. The WPTC allows parents to decide what is the best way to provide childcare. It is not limited to sending a child to a formal childcare center or program.

Trusting parents to decide family priorities

The WPTC is flexible. The credit can be used to pay for any and all necessities. It is a based on a belief that parents are the best deciders of what matters most to their family’s wellbeing. For some families it might be childcare, for others it could be housing, food, or transportation.

Assisting far more households than any program can

There is no program/supply side solution the state can afford that can deal with the childcare challenge at scale. The current state childcare subsidy program serves around 30,000 children. The governor’s Tri-Share program – which asks employers, parents, and the state to share the cost of care – serves fewer than 1,000 children. The WPTC will serve around 250,000 children.

Easy to apply for and quality for

The reality is that far too many working households are shut out of benefits they are eligible for by a confusing and limited scale system of safety net programs. All eligible parents need to do to receive the WPTC is file their taxes. If you receive the EITC, have $10,000 in household work earnings, and have children under the age of six, you will receive the full working parents tax credit.

The Working Parents Tax Credit is a win for Michigan families raising young children, employers, and the overall state economy. It meets the criteria of good tax policy. It is fair (targeting relief to those most in need), efficient (tied directly as an incentive to work), and simple (no new bureaucracy). Now is the time to enact a Working Parents Tax Credit.