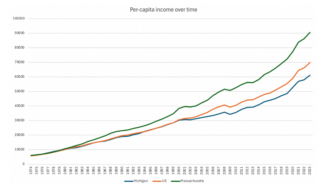

For nearly two decades we have recommended that Michigan make Minnesota the model for its economic policy. We chose Minnesota because year after year after year it is the most prosperous Great Lakes state. It not only is a neighboring state, it also is a cold weather state and a non-costal state.

The recently released 2023 state per capita income data makes clear once again that Minnesota has the economy Michigan should want to have. Michigan is 39th in per capita income at $61,144, 12.4 percent below the national average. Minnesota is 12th in per capita income at $72,557, 3.9 percent above the national average. All a Great Lakes state best.

The two Great Lakes states that policymakers of both parties almost always compare Michigan to––Ohio and Indiana––are also low-prosperity states. Ohio is 37th in per capita income at $61,495, 11.9 percent below the national average. Indiana is 38th in per capita income at $61,243, 12.3 percent below the national average.

Minnesota also is the Great Lakes state with the highest proportion of adults with a B.A. or more. It is 11th in the nation. Michigan is 34th, Ohio is 37th, Indiana is 42nd. The proportion of adults with a B.A.or more is probably the best predictor of a state’s per capita income. Because college-educated talent is the asset that matters most to high-wage employers.

What has Minnesota done to become the Great Lakes’ most prosperous state? In 2014 we asked Rick Haglund to answer that question. His report, State Policies Matter: How Minnesota’s Tax, Spending and Social Policies Helped it Achieve the Best Economy Among Great Lakes States, is as valid today as it was a decade ago. Yes the data in the report needs updating, but Rick’s description of the path Minnesota has taken for more than five decades is still accurate today.

Rick’s conclusion:

Lawmakers and governors in many states, including Michigan, have focused primarily on cutting taxes and shrinking the size of their governments as the path to prosperous economies. As this report has shown in detail, Minnesota has traveled a different path. There is no question Minnesota is a high tax state—as stated earlier, its residents paid $2,309 (updated for 2023) more than Michigan residents in state taxes alone.

But it has largely invested that additional revenue in services and investments that matter in a knowledge-based economy. An educated workforce, efficient transportation systems, vibrant cities and metropolitan areas, and a secure safety net for those making the transition to a global economy all matter in creating a prosperous state.

Minnesota has made those necessary investments and enacted policies making the state welcoming to all. It really shouldn’t be surprising, then, that it has the strongest economy in the Great Lakes region and one of the most vibrant in the country.

Maybe most important is what isn’t part of the Minnesota playbook:

- Minnesota did not lower taxes. In fact as Rick documents, in 2013 when Michigan was slashing business taxes, Minnesota raised taxes on companies and the wealthy. In 1980 Minnesota had the 6th highest state taxes per capita in the country. Michigan ranked 13th. Minnesota’s state taxes per capita were 122 percent of Michigan’s. In 2023 Minnesota had the 8th highest state taxes per capita in the country. Michigan ranked 34th. Minnesota’s state taxes per capita were 162 percent of Michigan’s.

- Minnesota did not slash its safety net. As Rick wrote: “Many states have cut benefits to the poor and unemployed in the belief that these payments dissuade people from looking for paid work. Minnesota takes a different view. It has created one of the strongest safety nets in the country, spending generously on benefits to help those who have lost jobs or been stricken by poverty get back on their feet. That protective net has not trapped Minnesotans and turned them into a bunch of government-dependent slackers. Far from it.”

- Minnesota does not offer big incentives for economic development projects. Read the Minnesota Economic Development Resource Guide and you will not find any big incentive program like SOAR, Michigan’s new billions of dollars business incentive program.

Michigan has, of course, done the exact opposite. On a bipartisan basis accepting that high taxes, particularly on businesses are job killers, the state has anchored its economic development playbook on cutting taxes for at least three decades. And, also on a bipartisan basis, enacting one version after the other big economic development incentive programs. As well as slashing the state’s safety net in part on the belief that a more generous safety net discourages people from working.

At its core the Minnesota playbook for economic success has been higher taxes used for public investments to compete for talent by offering good schools from birth through colleges and

creating places where people want to live by offering high quality basic services, infrastructure and amenities.

Minnesota focus on making public investments in education from birth through college and creating high quality of living communities combined with being welcoming to all is the foundation for its economic well-being success. Minnesota has developed a policy playbook that makes preparing, retaining and attracting talent its economic development priority one. That is exactly what is needed in today’s economy where talent attracts capital.