This post is a correction and update of a post originally published in April 2022.

Important new report from United for ALICE entitled ALICE in focus: Children in financial hardship. United for ALICE found that nearly one million (946,119) children (17 or younger) in Michigan — 44% of all children — lived in a household with income below the ALICE Threshold of Financial Survival in the robust, pre-pandemic Michigan economy of 2019.

These households include those in poverty as well as those who were ALICE: Asset Limited, Income Constrained, Employed. Michigan households below the ALICE threshold don’t earn enough to afford the essentials of housing, child care, food, transportation, health care, a smartphone plan, and taxes — the basics needed to live and work in the modern economy.

In this post I want to focus on the children living in a household below the ALICE threshold with at least one working adult. 842,000 Michigan children lived in a working ALICE household. 89 percent of all Michigan children in ALICE households. So nearly nine in ten children living in households that cannot pay for basic necessities live in a household with at least one working adult.

In Michigan in 2019 there were 1,974,000 children living in households with at least one working adult. So more than four in ten (43 percent) Michigan children in working households lived in households below the ALICE threshold.

Of the children living in households with incomes below the ALICE threshold 11 percent were in households with no worker; 55 percent in households with one worker; and 34 percent in households with two or more workers.

The Children in Financial Hardship Michigan report summarizes the findings:

The largest driver of a child’s financial stability is the employment status of household members. In 2019, most children in Michigan lived in a household with at least one worker (94%). But having working parents or guardians does not guarantee financial stability.

Children living with two adults were more likely to be financially stable than children living with a single parent or guardian. Yet even in households with two working adults, 23% of children were below the ALICE Threshold. When only one of two adults worked, the rate increased to 56%. Children living in a household with a single working parent or guardian were even more likely to be below the Threshold (72%).

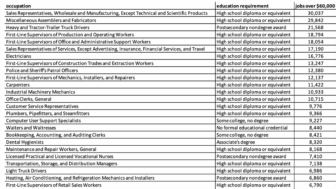

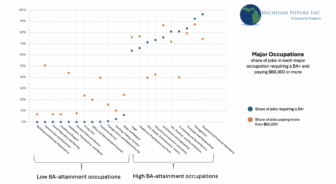

These data are consistent with our findings that Michigan’s high ALICE rate is primarily caused by too many of us work in low-wage jobs. Nearly six in ten Michigan jobs pay less than what is required for a family of three to be middle class ($47,000). That is more than 2.5 million Michigan jobs in a robust economy that paid less than what it takes to be a middle class household of three.

The pandemic made clear that these low-wage workers live paycheck to paycheck not because they are irresponsibly buying “unnecessary” luxuries, but because they are in low-wage jobs that leave them struggling to pay for the necessities. The reality is that most of those struggling economically, in good times and bad, are hard-working Michiganders who like us get up every day and work hard to earn a living. The United for ALICE data make clear that many of these hard-working low-wage workers are raising children.

If we are serious about achieving an economy that as it grows benefits all Michiganders, and if we are serious about Michigan being a place that provides equal opportunity for all its children, we need to figure out how to increase income and benefits of lower-wage workers.

What these lower-wage workers need most is income, not programs. For us that means starting with a big increase in the state’s Earned Income Tax Credit. Michigan’s recent historic expansion of the EITC can help all 842,000 Michigan children living in a working ALICE household.

- The maximum federal credit for a household with one child is $3,733. Michigan’s expansion of the state’s match of the federal credit from six percent to 30 percent increases the state maximum credit from $224 to $1,120.

- The maximum federal credit for a household with two children is $6,164. Michigan’s expansion of the state’s match of the federal credit from six percent to 30 percent increases the state maximum credit from $370 to $1,849.

- The maximum federal credit for a household with three or more children is $6,935. Michigan’s expansion of the state’s match of the federal credit from six percent to 30 percent increases the state maximum credit from $416 to $2,080.