Below is the text of a letter to the Governor, Senate Majority Leader and Speaker of the House sent by Tom Hickson, Vice President of Public Policy and Advocacy Michigan Catholic Conference; Andrew T. Johnston Senior Vice President, Advocacy & Strategic Engagement Grand Rapids Chamber of Commerce; Alexa Kramer, Director of Government Operations Small Business Association of Michigan; and Brad Williams, Vice President of Government Relations Detroit Chamber of Commerce. The letter makes the case for a big expansion of Michigan’s refundable Earned Income Tax Credit.

Dear Michigan Leaders,

Thank you for your continued commitment to shepherding our state through these unprecedented times. We write to encourage you to utilize historic state revenues on programs and proposals that have the most transformational impact on Michigan’s future.

Our four organizations collectively represent more than 50,000 members and the millions of Michiganders we serve. On their behalf, we urge you to make increasing the Michigan Earned Income Tax Credit (EITC) a top priority as tax reform negotiations continue.

As you work to find common ground, the EITC is a bipartisan proposal that is simple, effective and one that will have the most positive, significant impact. From our view, increasing the EITC will provide a large mutual benefit for kids, workers, businesses and the local and state economy. The EITC proposal has widespread, diverse support, as nearly 100 organizations from every sector and region in the state are advocating for its expansion.

The EITC is a pro-family, pro-work policy that rewards the dignity of work and helps low income workers, including single mothers, to transition to a better income level and provide for necessities and cover emergency expenses.

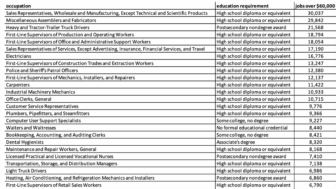

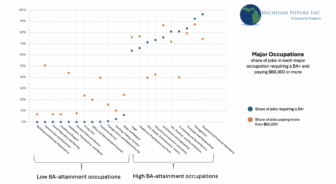

Michigan’s EITC provides help to working families struggling to make ends meet by boosting after-tax incomes, pulling Michigan families above the poverty line and reducing inequities. But at its current rate of only 6% of the federal credit, Michigan’s EITC is among the lowest in the nation, and can and should be doing much more to meet the needs of struggling families. Increasing the EITC to 30% would put an average credit of $750 into the hands of workers and families with the greatest need and an additional $443 million for local businesses as recipients spend it on immediate essentials.

At a time when many employers are having difficulty filling available jobs, the EITC also has a proven track record of encouraging people to enter the workforce. In fact, it was what the EITC was specifically designed to do – encourage greater participation in the workforce and help workers with lower incomes make ends meet. The EITC increases local purchasing power, and the higher the credit, the more money gets spent locally on things like gas, groceries and child care.

The EITC is more so a work incentive than a public assistance program. But the EITC’s power as a pro-work, anti-poverty tool is due in large part to its refundability, and it is vital that any increase to the EITC does not eliminate this piece. Refundability is crucial to the state EITC benefiting the Michiganders who need it the most and ensuring they receive the full credit. Among the 31 states with their own EITC, 27 of them (87%) have a refundable credit or a refundable component of their credit, and Michigan should maintain its spot on the right side of that equation.

Research from the national Institute on Taxation and Economic Policy shows that even with an increase to 30% of the federal credit, which would be putting an average credit of $750 into the hands of workers, eliminating refundability would actually raise taxes on the average worker earning less than $23,000. Michigan’s own Department of Treasury has compiled similar data and estimates that about 300,000 Michigan taxpayers would see a tax increase, rather than a benefit by moving from a refundable credit to a nonrefundable one. This data reiterates that any change to refundability would dramatically offset the intended impact of any increase to the credit.

Refundability has long-lasting benefits for families and children and is also a net positive for the economy. Because the EITC is distributed as a lump sum once a year, it gives families with low incomes a one-time boost to their income that can be used to make a large purchase, like a car repair. The Federal Reserve estimates EITC recipients spend nearly half of their refunds within two weeks of receipt. Importantly, much of this money is spent at local businesses in the communities where recipients live.

For an EITC increase to have the desired impact and provide a net gain for struggling workers and families, we appreciate the due diligence around creating a potential benefits cliff by significantly increasing the state credit. But increasing Michigan’s EITC would actually have the opposite effect.

Several states have explored or implemented a refundable EITC as a measure to reduce benefit cliffs. One state’s benefit cliff study commission found the EITC, “would smooth out cliffs with a broad brushstroke, reducing the need to calibrate improvements to the cliffs across a set of benefits.” Benefits cliffs are most harmful when workers make job and career decisions based on short-term financial considerations.

Unlike other safety net programs, the EITC actually increases as earnings increase and is available up to a higher income threshold. Additionally, at upper income levels, the benefit gradually phases out, so workers can continue to earn more money or take on additional hours without losing the entire value of their credit. Because the value of the EITC largely increases while the value of other public benefits decline, the credit can be thought of as a way to combat a benefits cliff. When earnings increase for working families, a larger EITC means more support, and an increase to the state EITC will alleviate a benefits cliff and help provide economic security and stability.

The billions of dollars in state revenues provides a major opportunity for you to define your respective and collective legacies. As future Michiganders look back at the decisions you will be making in these next few days, weeks or months, increasing the EITC would be a major win for bipartisanship, kids and parents, and workers and businesses. The benefits will immediately pump through our economy. And the direct boost to parents’ incomes will benefit their children for years to come, creating a better future for the state as a whole.

We are extremely grateful for your previous support for increasing the Michigan EITC in the past

few months, and as you work toward final resolution on the budget and investing additional

revenue, we urge you to consider increasing Michigan’s EITC benefit.

Should you have any questions, we would be happy to discuss the merits and benefits of increasing Michigan’s EITC. Thank you for your consideration.