Terrific Bridge article on how hard it is for way to many out-of-work Michiganders to get unemployment insurance. The article’s title says it all: Michigan unemployment system designed to slow payments working all too well.

Bridge writes:

A big source of the problem, according to experts: The $52 million Michigan Integrated Data Automated System, known as MiDAS, a computer system designed to save money by flagging fraud, taking human review out of the unemployment claims process and using algorithms to identify “non-monetary issues” that end up delaying or invalidating claims.

“MiDAS was programmed to assume people were guilty, and because of that programming, when it’s needed, people aren’t getting their benefits,” said Tony Paris, an attorney for the Sugar Law Center in Detroit that has sued Michigan over its unemployment system.

… When Michigan set out to overhaul its unemployment insurance system a decade ago, its top priority wasn’t ensuring timely benefits for residents or building capacity to handle huge claims in the event of a recession — let alone a pandemic.

It was to “reduce the costs of operations” by weeding out fraud and streamlining the claims process, according to a 2010 request for bids issued in the waning days of former Gov. Jennifer Granholm’s administration.

The Michigan unemployment insurance application process is designed, first and foremost, to catch those who don’t “deserve” public benefits. So we end up with an application process that takes way too long to help people who need benefits to pay the bills now. Not to mention has long and confusing applications that are difficult for many to complete so that it, almost certainly, keeps benefits from far more who are eligible than screens out those who aren’t.

And its not just unemployment insurance that is designed to make it hard to get safety net benefits. This is a structural problem that requires a complete redesign of all of Michigan’s safety net programs.

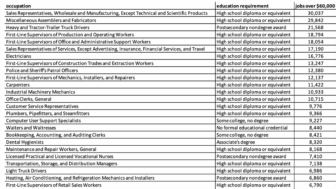

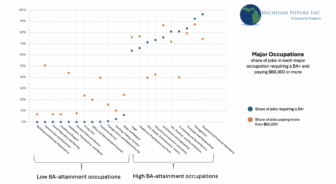

This catch the so-called undeserving and/or the fraudsters first approach to safety net design of course has real life consequences. It means far too many Michiganders out of work through no fault of their own or who need safety net benefits to supplement their low-wage work can’t afford the basics: food, housing, health care, child care, transportation and so much more.

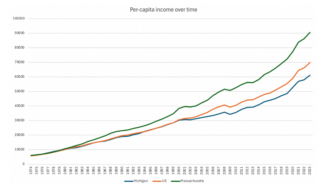

Today’s economic reality––not to mention the lesson we should have learned from the Great Recession––should make clear to all of us that a vast majority of those struggling economically and without any safety net to deal with emergencies are hard working Michiganders. Who, like us, get up everyday and work hard to earn a living. That the prime reason for so many struggling is not irresponsible adults coddled by a too-generous public safety net, but rather an economy, even when it was booming, has too few jobs that pay family-sustaining wages and provides health coverage and paid leave.

Neel Kashkari, president and chief executive of the Federal Reserve Bank of Minneapolis, summed up best what our approach should be to the current economic crisis when he wrote:

Err on the side of helping as many workers and businesses as possible rather than on prudence. This is not the time to worry about moral hazard or whether people are incentivized not to work. When the covid-19 crisis is behind us, if our biggest complaint is that some workers and small businesses got help when they didn’t really need it, that would be a wonderful outcome for our country.

The Bridge article is more evidence, as we have explored previously that Michigan need to go to a no red tape cash-based safety net. It is far past time that Michigan both expand safety net benefits––we have been going in the opposite direction for more than a decade––and make it far easier to apply and receive those benefits. As Kashkari concludes: that would be a wonderful outcome for our state.