The Federal Reserve recently published their Report on the Economic Well-Being of U.S. Households in 2017. It reports on the results of a survey of American’s ![]() assessments of their economic well-being. The report is worth reading. It’s a great overview of how well American households are doing economically today.

assessments of their economic well-being. The report is worth reading. It’s a great overview of how well American households are doing economically today.

The report finds that 42 percent of American households in a strong economy have a high likelihood of financial hardship. Quite similar to the 40 percent of households the Michigan Association of United Ways found could not pay for basic necessities. So structurally we have an economy that is leaving far too many households behind no matter how strong the economy is.

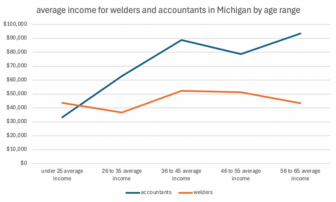

The report breaks down responses by education attainment. Which is the part of the report I want to detail in this post. Across the board those with a four-year degree or more are doing better than those with lower education attainment and they are also more satisfied with their education than those with less than a four-year degree. So much for the story we are told over and over again by way too many of our business and political leadership that people would be better off forgoing a four-year degree.

Let’s start with economic well-being by education attainment. 85 percent of those with a four year degree or more say they are at least doing okay financially compared to 70 percent of those with some college or an associate degree and 66 percent of those with a high school degree or less. The Federal Reserve’s analysis finds that a too-high 29 percent with a four-year degree or more face a high likelihood of financial hardship, compared to 46 percent of those with some college or an associate degree and 50 percent for those with a high school degree or less.

The report concludes:

Economic well-being rises with education. Associate degree holders are somewhat more likely to be at least doing okay financially than those with some college or less, although a larger increase is associated with a completion of a bachelor’s degree.

Those with a four-year degree or more also assessed the value of their education more highly than those with with lower education attainment. The report concludes: “… among those who attended college but are not enrolled and did not complete at least an associate degree, only one in three say their education was worth the cost. This fraction jumps to 46 percent for those with just an associate degree and 67 percent among those with at least a bachelor’s degree.”

(There also is a big difference in terms of assessed value of a degree by the kind of institution attended. For those with an associate degree 47 percent think they got more value than the cost at a public two-year college, 55 percent at a private non-profit and 32 percent at a private for-profit. For those with a four-year degree or more 71 percent think they got more value than the cost at a public university, 64 percent at a private non-profit and 44 percent at a private for-profit.)

When asked what changes would you make now to earlier education decisions

- 37 percent of those with a four-year degree of more say they would have gotten more education, five percent say less

- 67 percent of those with some college or an associates degree say they would have gotten more education, seven percent say less

- 74 percent of those with a high school degree of less say they would have gotten more education, 13 percent say less

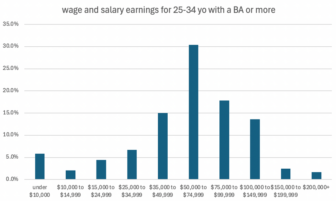

The report also includes data on student loans. Which provides more evidence that the story told over and over again of students with four-year degrees being crushed by student loans is inaccurate to say the least. The report finds:

Forty-two percent of those who attended college, representing 30 percent of all adults, have incurred at least some debt from their education. This includes 22 percent who still owe money and 20 percent who have already repaid their debt. … Of those who are making payments, the typical monthly payment is between $200 and $300 per month.

Among those with outstanding student loans from their own education, 20 percent were behind on their payments in 2017. … Over one-third with student loans outstanding and less than an associate degree are behind versus one-quarter of borrowers with an associate degree. The delinquency rate is even lower among borrowers with a bachelor’s degree (11 percent) or graduate degree (5 percent).

Finally the report includes data on four-year degree attainment by parents education. 71 percent of the children who grew up in a household with at least one parent with a four year degree earned at least a bachelors degree. For children where both parents have a high school degree of less 19 percent earned at least a bachelors degree. More evidence that, by and large, the elites that are telling us not to get a four-year degree mean that only for other’s kids, not their own.