The Atlantic recently explored what the American economy might look like with full employment. Using today’s metro Des Moines as the example. It’s a region with ![]() very low unemployment and a high employment to population ratio. What is happening in Des Moines is reaffirmation that full employment matters. It tilts the balance of power towards workers in an economy that for decades has been going the other way. The Atlantic summarized the positives this way:

very low unemployment and a high employment to population ratio. What is happening in Des Moines is reaffirmation that full employment matters. It tilts the balance of power towards workers in an economy that for decades has been going the other way. The Atlantic summarized the positives this way:

Around the country, and especially in central Iowa, the low unemployment rate has slowly but surely tipped the balance of power away from employers and towards workers, who here in the Hawkeye State have been able to demand higher wages, better working conditions, more generous benefits, training programs, and myriad other perks.

Wage growth is picking up but still anemic. The employment to population rate is going up to as the strong economy draws more off the sidelines. The biggest change seems to be in who gets hired, including employer’s offering training rather than only hiring those deemed employment ready. The Atlantic writes:

Iowa’s tight labor market has forced employers to offer training, reach out to new populations of workers, and accept applications from workers they might not have before — expanding and up-skilling the labor pool as a whole as a result. “Their attitude really seems to be changing,” said Soneeta Mangra-Dutcher of Central Iowa Works, a workforce development nonprofit. “They are looking at populations differently, who they should be looking at when they have jobs to fill, or people being screened out for things that really don’t have an effect on the job.”

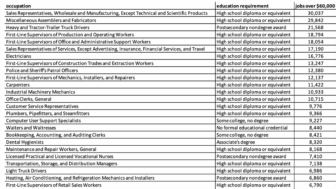

Good news indeed! But what full employment in Des Moines has not fixed and is highly unlikely to do so no matter how much demand for workers exceeds the supply of workers is the high number of jobs that don’t pay enough to allow workers to pay for basic necessities. The Atlantic reports:

Low wages continue to be an extraordinary problem preventing workers from connecting with a good job and keeping potential employees on the sidelines — in Iowa and across the country. “Even though we’re such a low unemployment state, we are also low-wage state,” Buck of the United Way (Elisabeth Buck, the president of the United Way of Central Iowa) said. “People think that when you have a state or a community that has low unemployment, that everyone’s doing great. That is not the case. We still have about 34 percent of central Iowans who are not making enough to be financially self-sufficient.”

… Plus, though central Iowa’s low jobless rate has helped workers of color, less-educated workers, younger workers, and others who face discrimination in the labor market, it remains true that it is the best-off that have done the best. Growth and low unemployment are not a cure for inequality, and it would take years and years and years of full employment to restore financial security to the middle class and to boost the fortunes of the poor. “There are many people who are working multiple jobs and are still living in poverty here,” Fugenschuh (Julie Fugenschuh, the executive director of Project IOWA, a training initiative for local workers) told me. “The unemployment rate is really not a number that says we’re doing super great.”

Lots of low wage/no or low benefits work is a structural feature of the American economy. It is a reality no matter how strong the economy is. Yes a strong economy is better for American households. But it is not enough to produce an economy that is working for everyone. So we need economic policy that makes a rising household income the goal. Rather than assuming that a low unemployment rate will benefit all. Shared prosperity needs to become a priority.

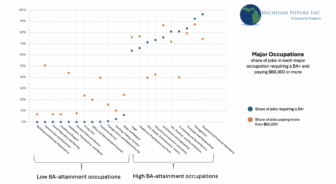

What a shared prosperity agenda for Michigan should look like is the subject of our A Path to Good-paying Careers for all Michiganders: Sharing prosperity with those not participating in the high-wage knowledge-based economy report . The recommendations include raising employment earnings (wages and benefits) for those in lower-paid work by some combination of employer mandates and/or an expanded safety net (including an expansion of the Earned Income Tax Credit, health insurance and child care benefits).

No, Michigan does not have a too generous safety net that discourages people from working. As we documented in our State Policies Matters report Minnesota has a far more generous safety net than Michigan. And it is second nationally in the proportion of those 16 and older working, Michigan is tied for 37th. If the same proportion of Michiganders age 16 and above worked as Minnesotans there would be 725,000 more Michiganders working today.