Updated data from Joe Cortright of Impressa on the continuation of young professionals choosing to live in central cities. ![]() Cortright, using American Community Survey data, looks at the change in the number of 25-34 year olds with a four-year degree living in the largest city in each region with a population of one million of more from 2012-2016.

Cortright, using American Community Survey data, looks at the change in the number of 25-34 year olds with a four-year degree living in the largest city in each region with a population of one million of more from 2012-2016.

Cortright found:

The number of well-educated young adults living in the nation’s largest cities increased 19 percent between 2012 and 2016, about 50 percent faster than the increase outside these large cities.

Well-educated young adults were already highly concentrated in large cities, and are more concentrated today; in 2012, a 25 to 34 year old with a four year degree was about 68 percent more likely to live in a large city than the typical American; by 2016, they were 73 percent more likely to live in a large city.

He found that in 51 of 53 cities there has been growth. (The two with declines are Rochester, New York and Tucson, Arizona.) Detroit’s young professionals grew from 10,532 to 17,261. Grand Rapids grew from 12,517 to 18,012. Good news for both. But they both have a long way to go to be a talent magnet.

There were nine cities that saw the number of young professionals grow by more than 20,000 from 2012-2016. New York City is in a league of its own adding nearly 84,000 for a total of nearly 763,000. The other cities in the top nine were in order of their growth: Los Angeles, Chicago (no Chicago is not collapsing), Philadelphia, Austin, Houston, Seattle, Boston and San Fransisco.

This, of course, is not new. It’s a continuation of college-educated Millennials choosing to live in central cities in much larger proportions than previous generations. Why it matters to all of us, is that the regions that are anchored by a vibrant central city that is a talent magnet are high-prosperity regions.

Each of the top nine central cities listed above anchors a region with per capita income higher than both metro Detroit and metro Grand Rapids. Ranging from $51,566 in metro Austin to $84,675 in metro San Fransisco (which is a separate region from Silicon Valley) compared to $48,692 in metro Detroit and $46,519 in metro Grand Rapids. (You can find the regional per capita income data here.)

It is also worth noting that, with the exception of Houston, all are a finalist for Amazon’s HQ2. And, of course, Detroit and Grand Rapids are not.

Amazon’s HQ2 search is representative of the new reality that in the growing high-wage knowledge-based sectors of the global economy talent—those with a four-year degree or more—is the asset that matters most and is in the shortest supply. And that is directly connected to prosperity, measured by per capita income. Because knowledge-based sectors are the only part of the American economy that is both growing and high wage.

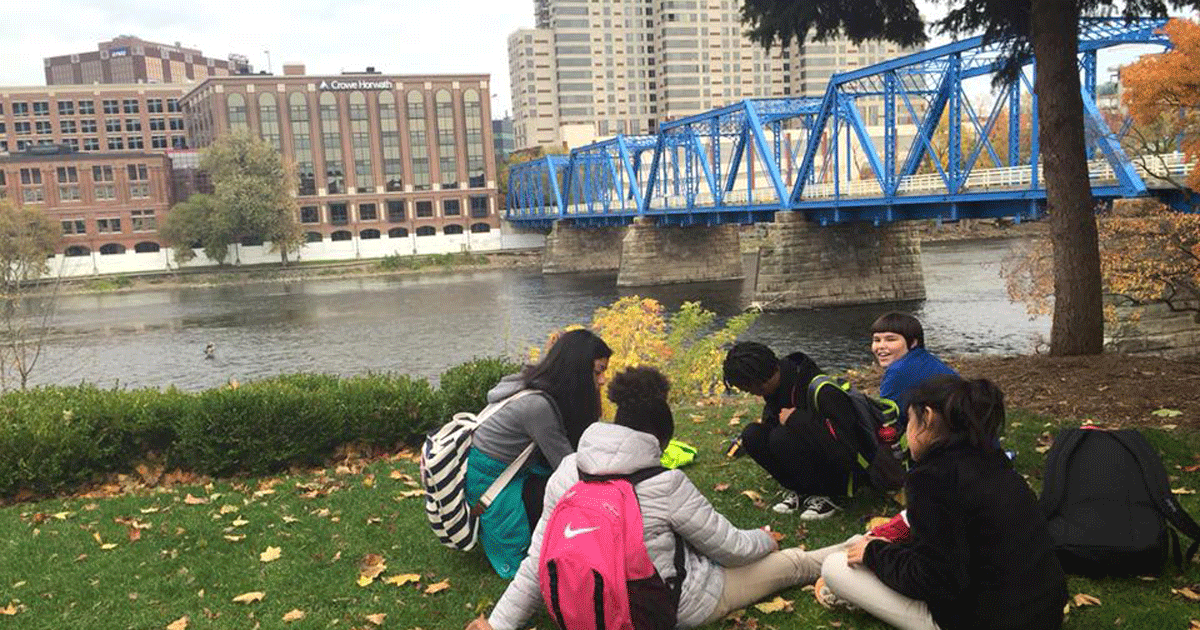

The lesson that Michigan needs to learn––and is having a hard time doing so––is that vibrant central cities––particularly Detroit and Grand Rapids––are essential to regional and the state’s return to high-prosperity. And that requires public investment in placemaking. As we wrote in our new state policy agenda report:

The places where talent is concentrating are increasingly big metros with vibrant central cities. Central cities because mobile talent increasingly wants to live in high-density, high-amenity neighborhoods where you don’t have to own a car. The evidence from around the country is that quality of place is an—if not the most—important component in retaining and attracting talent. Places with quality infrastructure, basic services and amenities are the places that retain and attract talent the best