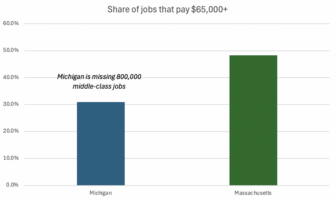

A core finding of Michigan Future’s research has been that what made us prosperous in the past, won’t in the future. The big change is that prosperity is now aligned with knowledge-based rather than factory-based economies.

Another big change is that renters are now an asset not a liability in a community’s economic well being. We have been told for years that homeowners increased a community’s well being, renters diminish it. Think again!

Richard Florida summarizes the data in a recent City Lab article this way:

Homeownership is no longer the key driver of America’s industrial economy. Across the U.S., cities and metros with higher rates of homeownership have had more trouble adjusting to the demands of the knowledge economy, trapping their residents in housing they cannot sell and limiting their ability to adjust to economic downturns. Meanwhile, cities and metros with more renters have proven better able to cope with the transformation from an industrial to a knowledge economy.

In fact, metros with greater shares of renters have higher wages, higher productivity (measured as economic output per capita), and greater concentrations of high-tech firms, according to Mellander’s basic correlation analysis. Metros with greater shares of renters also have higher concentrations of highly educated adults with college degrees and a greater share of the workforce made up of creative class workers in science and technology, knowledge-based professions, and arts, culture, entertainment, and media. Metros with greater shares of renters are also substantially denser and more diverse—two other factors that contribute to innovation, creativity, and economic growth.

On the flip side, metros with higher levels of homeownership are less innovative, less productive, less diverse on average, and have less talent. These associations are even more pronounced when we look at just the 51 large metros with more than one million people.

The Millennials, of course, are a big part of this transition. As we have noted frequently they are far more likely to choose to live and work in big cities than previous generations. Concentrating in high density, high amenity, mixed use neighborhoods in and around central city downtowns. And, at least before they have children, they rent more than previous generations. The conventional wisdom is that they only rent because owning a home is too expensive. A continuation of the long held notion that renting is an inferior good. I’m not so sure that is the case. Just like driving less, the preference for renting may well be a generational change in consumer preferences. Even if one can afford a car or to own a home, some choose to do neither.

Florida concludes his article with a call for a fundamental shift in housing policy. Which is tilted heavily in favor of homeownership rather than renting, and in favor of suburban sprawl rather than central cities. Florida writes:

All of this begs for a change in America’s housing policies. Currently, many policies incentivize homeownership and the construction of wasteful, energy inefficient, sprawling suburbs in addition to conferring large subsidies on relatively wealthier homeowners. In the future, they should become more neutral with regard to multifamily rentals versus single-family homeownership, while conferring subsidies on low-income renters who bear the largest housing cost burdens.

Exactly. Other than the basic equity in treating households who want to rent the same as those who want to buy a home, this kind of policy shift is also important to growing the economy. Michigan is struggling with retaining and attracting young professionals. And where they choose to live and work, economic prosperity goes with them. One of the assets than Michigan is missing is a supply of the kind of rental housing that young professionals are demanding. Particularly in and around downtown Detroit where demand exceeds supply. Its far past the time when we think of renters as the kind of people we don’t want in our community and understand the new reality that renters are major contributors to economic prosperity.