I’m reading Jonathan Clements’ Money Guide 2015. Not for work. But his first two paragraphs of the first chapter are very much about Michigan Future’s work. Clemens writes:

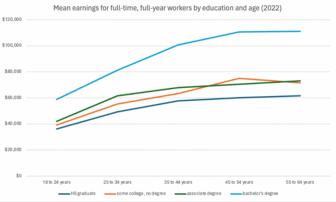

Imagine you are a freshly minted, penniless college graduate with alarming student loans and an unhealthy credit card debt. Your net worth? It’s likely measured in the millions.

Over the next four decades, you might pull in tens and perhaps hundreds of thousands of dollars every year. To get a handle on how valuable that income stream is, consider how much you would need to invest in bonds or certificates of deposit to generate a comparable amount of annual income.

Clements’ is also right when he writes later in the book: “While most types of debt have been shrinking over the last six years, students loans have soared by 84 percent.The money borrowed should help make the U.S. more productive and help students involved earn higher lifetime incomes. Still, this burgeoning debt speaks to the financial sloppiness of the baby boomers, who are providing notably little financial help to their college-bound teenagers, thus compelling them to borrow more.” (Emphasis added in both quotes.)

Exactly! In two quotes Clements’ lays out the basic realities about college attainment and financing. (Each increasingly challenged by what passes for conventional wisdom.)

- Getting a college degree––even if it means taking out student loans––is the best investment one can make. It is by far the best way for most of us to have a net worth as Clements’ puts it in the millions.

- When more of us get college degrees the American economy does better. Increased education attainment is the prime driver of productivity growth and that is what grows economies and standards of living

- The prime reason for higher tuition and higher student loan debt is the increasing disinvestment in public higher eduction, particularly by states like Michigan. My generation, the Boomers, enjoyed low tuition primarily because state taxpayers were paying a big part of the cost of college at public universities. The Boomers have not returned the favor to their children. Instead preferring lower taxes, higher spending on health and corrections rather than higher education.