We are all told that we need to have savings of 3-6 months to deal with emergencies. One of the lessons we are learning from our pandemic-driven economy is that a lot of workers don’t earn enough to have savings.

Everyday, in every community in Michigan, we are confronted with the vast number of low-wage workers in the leisure, hospitality, retail and personal services industries who have lost their jobs and no longer can make ends meet. As well as those who get us food and prescription drugs and who care for us who are not only putting their lives on the line to serve us but also are struggling to pay for the necessities.

They live paycheck to paycheck not because they are irresponsibly buying “unnecessary” luxuries, but because they are in low-wage jobs that leaves them struggling to pay for the necessities. As we wrote in a previous post:

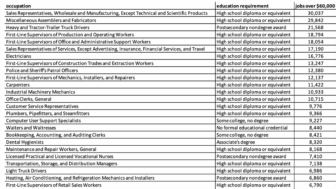

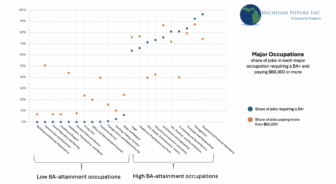

That reality should now make clear to all of us that a vast majority of those struggling economically and without any safety net to deal with emergencies are hard working Michiganders. Who like us get up every day and work hard to earn a living. That the prime reason for so many struggling is not irresponsible adults coddled by a too-generous public safety net, but rather an economy, even when it is booming, has too few jobs that pay family-sustaining wages and provides health coverage and paid leave.

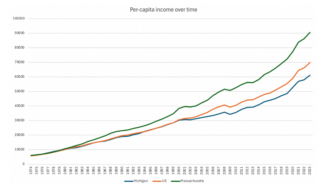

The Federal Reserve Board of Governors recently released a new quarterly data series that estimates the assets, liabilities, and net worth of American households in total and distributed among four percentile groups. This wealth is not equally distributed.

In 2018 the average net worth of the richest 1 percent of households was $24,561,596; the average net worth of the next richest 9 percent of households (90 to 99th percentile) was $3,371,803; while the average net worth of the 50th to 90th percentile group was $559,601. The poorest 50 percent of American households, however, had an average net worth of only $18,647.

You read the right. Half of American households––in a boom economy––had virtually no, particularly liquid, savings. This, of course, is consistent with the Feds’ finding that 40 percent of households couldn’t pay an unexpected $400 bill.

The Michigan Association of United Way’s basic necessities budget does not include savings. For a single adult the basic necessity threshold is $21,036, for a family of two adults with one infant and one preschooler it is $61,272. As the pandemic is teaching us there just aren’t enough jobs that pay enough to earn beyond those thresholds to be able to save.

Savings, of course, provides far more than the ability to get through an emergency. Everything from buying a house, to paying for education for ourselves and our kids and having a decent retirement depend on savings.

If we are serious about an economy that benefits all, being able to pay the bills during emergencies needs to be included. That means higher wages and better benefits for low-wage workers and/or an expanded safety net.

To their credit––on a bi-partisan basis––in both Lansing and Washington policy have temporarily expanded unemployment insurance and paid leave. Let’s hope that this pandemic-driven economy has taught policymakers that this is not a temporary problem, it is structural. That the need for higher wages and better benefits for low-wage workers and/or an expanded safety net is vital no matter how strong the economy.